Asia (China) Continues to Build Reserves, but Forex Diversification Slows: "

After a brief pause, the world’s Central Banks (or at least those in Asia) have begun to once again accumulate foreign exchange reserves. I’m not one for hyperbole, but the figures are downright eye-popping: “Reserves held by 11 key Asian central banks totaled $2.625 trillion at the end of August, up from $2.569 trillion at the end of July, according to calculations by Dow Jones Newswires.” Most incredible is that this total doesn’t even include China. whose reserves could exceed $2.3 Trillion by now.

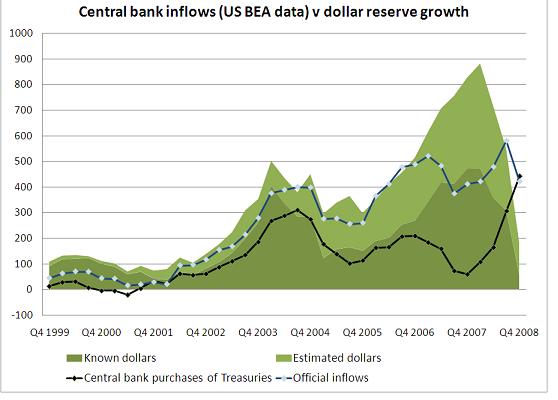

The credit crisis was initially marked by a collapse in trade and an exodus of capital from Asia, as western consumers tightened their wallets and investors flocked to so-called safe havens. As developing countries fought off currency depreciation, forex reserve levels plummeted. Less than a year later, trade has already picked back up, investors have returned en masse to emerging markets, and Central Banks are once again sterilizing capital inflows so as to mitigate upward pressure on their respective currencies. [Chart Below courtesy of Council of Foreign Relations.]

“Taiwan and Thailand, the most aggressive in defending the U.S. currency, have logged record-high reserves every month since December.” Japan, whose reserves are the second highest in the world (after China), is the lone holdout. As the Forex Blog reported yesterday, the newly elected Democratic Party of Japan will pursue an economic policy that depends less on exports, and has pledged to stay out of the forex markets.

The prospects for further reserve accumulation remain reasonably bright, as emerging markets lead the global economy towards recovery. “The outlook for key Asian economies is improving faster than that of developed economies. For the time being, this should accelerate flows into these markets, making it harder for central banks to keep their currencies in check.”

While China’s economy is no exception, its nascent recovery is being driven by capital investment, government spending, and (ultimately?) consumer spending. As a result, it is forecast that “China’s current-account surplus will fall to under 6% of GDP this year and 4% in 2010, down from a peak of 11% in 2007. Exports amounted to 35% of GDP in 2007; this year…that ratio will drop to 24.5%.” If such an outcome obtains, it will almost certainly lead to a slower accumulation of reserves.

While this is all well and good, the more important question for most (forex) analysts is how these reserves are being held. The vast majority of these reserves are still denominated in US Dollar assets, and in fact, the proportion may have risen slightly since the beginning of the credit crisis. Asian Central Banks are particularly biased towards the Dollar, which accounts for 70% of their reserves, compared to the worldwide Central Bank average of 64%.

Moreover, it doesn’t look like plans are afoot to change this trend anytime soon. China has maintained its push (though less vocally) to turn the Chinese Yuan into a global reserve currency, declaring that its capital markets and currency controls will open accordingly to facilitate such. It is in preliminary talks with Thailand for yet another currency swap agreement, to supplement the $95 Billion in such deals signed since December. For its part, the Bank of Thailand has insisted that the Yuan is not even close to challenging the supremacy of the Dollar: “You have to accept that the dollar is going to be a reserve currency for quite some time. You don’t have any alternatives.”

Even China, despite its rhetoric, remains committed to the Dollar. The only talk of diversification in Chinese investment circles is in regards to what kinds of US assets they should invest in, not whether they should be invested in the US or somewhere else. Said the manager of China Investment Corp, which has a mandate to invest nearly $300 Billion of China’s FX reserves, “The risk of a decline in the dollar risks was more of a national issue for China than for CIC because its capital is in dollars.”

This last quote inadvertently confirms that the role of the Dollar as the world’s reserve currency is being treated as a political issue, when in fact it is a financial economic issue. In other words, while many countries want to limit the influence of the US by limiting the power of the Dollar, their Central Banks are stuck with it because it remains the most practical, and advantageous option. Dumping it would be akin to punishing themselves.

"

"

Wednesday, December 9, 2009

Asia (China) Continues to Build Reserves, but Forex Diversification Slows

at

6:27 PM

·

Labels: Article Marketing

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment