“Strong Dollar” Policy is a Joke: "

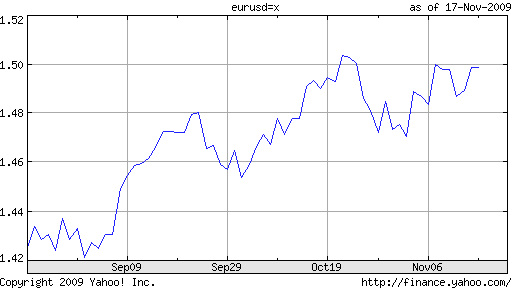

US economic officials have been busy of late, propagating the “Strong Dollar” farce to anyone who will listen. “I believe deeply that it’s very important for the U.S. and the economic health of the U.S. that we maintain a strong dollar,” said Treasury Secretary Timothy Geithner at last week’s APEC summit in Singapore. Added Ben Bernanke, Chairman of the Federal Reserve, “We are attentive to the implications of changes in the value of the dollar and…will help ensure that the dollar is strong and a source of global financial.”

The markets hardly reacted to Geithner’s assertions, probably because he has parroted this same promise on several occasions since assuming office last January. Investors can be excused for their jadedness, since similar promises were repeatedly made during the Bush administration, during which time the Dollar registered some of its steepest declines in memory.

Still, you’ve got to give Geithner an A for effort, since he has seemingly taken advantage of nearly every opportunity to pontificate about the Strong Dollar policy. ” ‘The dollar isn’t strengthening in the real world, but I told him [Geithner] I value his stance. The fact that I value his stance means that I believe things will develop that way, and that I believe the U.S. is making efforts to make that happen,’ ” said new Japanese Finance Minister Hirohisa Fuji. By his own admission, Fuji’s remarks were somewhat perfunctory, and it’s obvious to him the Dollar will continue depreciating

Bernanke, meanwhile, has more credibility on this issue, especially since the Fed so rarely discusses forex in public domain, which is why the Dollar initially spiked after he spoke. However, investors quickly registered the contradiction inherent in his remarks, which contained repeated promises about keeping rates low. Not to mention that the wording he used was almost identical to a speech from 2008. It’s no wonder, then, that the Dollar actually finished down on the day.

So if the markets aren’t taking this talk about a Strong Dollar seriously and Bernanke/Geithner know they aren’t being taken seriously, what’s the point of these vain pronouncements? [After all, it's not even clear that a strong Dollar is in the best interest of the US, which has benefited economically from a narrowing of the trade deficit]. A few explanations have been suggested.

The first is that the rhetoric is intended to re-assure foreign investors and creditors that their assets/loans in the US will be safe from massive devaluation. While foreign Central Banks continue to purchase US Treasury Securities, their have been increasing grumblings that loaning to the US government is a losing proposition. Second, a weak Dollar is inherently inflationary, since it makes imports more expensive. The reverse correlation between oil (and other commodities) and the Dollar means that a weak Dollar could feed back into higher prices double time. Towards that end, Bernanke was actually speaking earnestly about the Fed’s intentions to monitor forex markets, as they bear on inflation.

Finally, while US policymakers seem resigned to the Dollar’s continued decline, they need to make sure that it remains “orderly” (this characterization has cropped up repeatedly in political circles, of late). “We believe Chairman Bernanke’s comments reflect a desire to prevent a disorderly decline in the currency, rather than halt its depreciation altogether.” There is an obvious recognition that a complete collapse in the value of the Dollar would be terrible for everyone, of which Bernanke no doubt also undersds.

Still, the markets are keenly aware that the US (i.e. the Fed) is not prepared to put its money where its mouth is. The reason for the current bout of Dollar weakness is almost entirely connected to the Fed’s easy monetary policy (and its quantitative easing program) and the never-ending US budget deficit. If the US was seriously committed to a strong Dollar, then the Fed could simply tighten monetary policy. (The federal government could make more of an effort to balance its budget going forward, but this is currently less of a concern to forex markets).

Alas, the Fed is nowhere near ready to hike rates, nor is it willing to contemplate unwinding its quantitative easing program. Most analysts expect interest rates to remain at the current record lows well into next year. Futures contracts expiring in June 2010 are pricing in a Federal Funds Rate of only .42% at that time. Most telling is that Bernanke, himself, has declared rates will remain low for an “extended period.” In hindsight, using the same speech to talk up the Dollar probably wasn’tthe best idea.

"

"

0 comments:

Post a Comment