Japan’s Fujii Still Confused about Intervention: "

My last update on the Japanese Yen was published on October 16 (”Japan Flip-Flops on Forex Intervention). As the title suggests, I sought to overview the many instances of equivocation committed by newly-appointed Finance Minister Hirohisa Fujii in the name of Japan’s forex policy. I concluded that at that time, it was probably still premature to talk about forex intervention, but that if “the Yen continues to appreciate, then Fujii may have consider how fixed his [non-intervention] principles really are.”

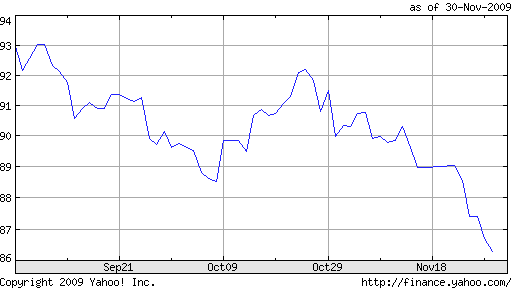

Since then, two things have happened. [Well really only one thing, since the second is more of a 'non-happening.'] Anyway, the first is that the Yen broke through the important technical/psychological level of 85 Yen/Dollar for the first time in 14 years. The second is that Mr. Fujii is still no closer to articulating a coherent approach to managing the Yen. Last week, alone, he referred to movements in the Japanese Yen as “extreme” and suggested that now was the time to remain vigilant and that “appropriate measures” are “possible.” A few days later, however, he called intervention “unthinkable.”

Given this nearly uninterrupted record of waffling, one might think to accuse Mr. Fujii of deliberately trying to confuse the markets. After all, how else can one explain the hourly changes in his forex policy. It’s ironic that Fujii himself has told reporters that, “It’s wrong to fuss over the currency market’s daily movement,” considering that his feelings on intervention seem to fluctuate in accordance with the Yen.

Thankfully, we may not have to deal with this carnival of uncertainty for much longer, as the Bank recently told reporters that “The government, not the BOJ, decides whether to intervene in currency markets.” At the same time, intervention would ultimately be carried out only under the auspices of the BOJ, which would presumably have the authority to determine a targeted valuation.

As for the million-Dollar question of whether intervention is more likely now that the Japanese Yen is closing in on a post-war record, it’s a bit more nebulous than it was in October. It seems that the political will now exists to intervene. The main obstacles are Fujii, himself, who had earlier pledged to administer a free-market approach to managing the Yen, and the international community.

Given that Japan still runs a trade surplus, it would be difficult to justify forex intervention. In addition, the Democratic Party of Japan (DPJ) made election promises to wean the Japanese economy off of its dependency on exports to drive growth and instead to cultivate a domestic consumer base. This promise was apparently reiterated to US President Obama during his visit to Japan earlier this month, and would be greatly embarassing if Japanese economic officials reneged so soon thereafter.

At the same time, politicians (of any nationality) are not exactly known for their integrity and their consistency, so it wouldn’t be surprising if they decided that in the context of the Yen’s continued strength that they decided to take action. “The sense of caution over the possibility of intervention is definitely higher now after the breach of Y85.00. We are all watching for any more comments from the authorities.” Given the political implications, however, it seems the more likely course of action would involve a tweaking of monetary policy – quantitative easing, under the guise of deflation fighting – rather than outright intervention. Such would be less awkward than intervention, and probably more successful.

"

"

0 comments:

Post a Comment